Introduction to Bank Owned Properties

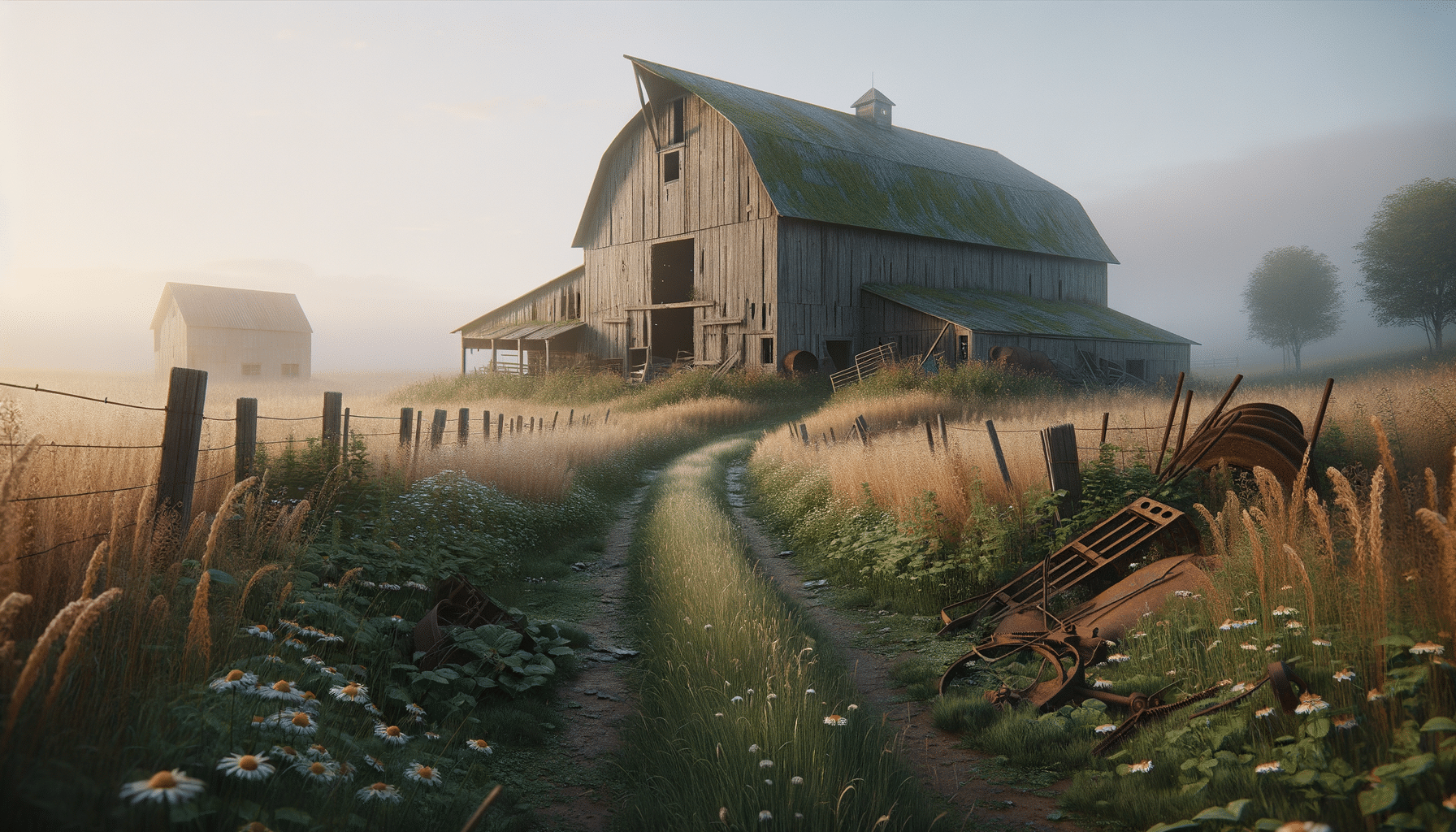

Bank owned properties, often referred to as Real Estate Owned (REO) properties, are homes that have been foreclosed and are now owned by a bank. This occurs when the property does not sell at a foreclosure auction, leaving the bank as the owner. These properties can be found in various stages of condition, and while they may offer potential savings, they also come with their own set of challenges. Understanding the dynamics of bank owned properties is crucial for anyone considering investing in real estate.

REO properties are typically sold “as-is,” which means that the buyer is responsible for any necessary repairs or renovations. This can be a significant factor to consider, as the condition of these properties can vary widely. On the other hand, banks are often motivated to sell these properties quickly, which can lead to opportunities for negotiation and potential discounts on the purchase price.

The Process of Acquiring Bank Owned Properties

Acquiring a bank owned property involves several steps, beginning with identifying available REO listings. These properties are typically listed by real estate agents who have been contracted by the bank to sell them. Potential buyers can find listings through various online platforms, real estate agents, or directly from the bank’s website.

Once a property has been identified, the next step is to conduct a thorough inspection. This is crucial as REO properties are sold “as-is,” and understanding the property’s condition can help in making an informed decision. After the inspection, a buyer can make an offer. It’s important to note that negotiations on bank owned properties can differ from traditional real estate transactions. Banks may have specific procedures and timelines, and understanding these can be beneficial in successfully acquiring the property.

Advantages of Investing in Bank Owned Properties

Investing in bank owned properties can offer several advantages to savvy buyers. One of the primary benefits is the potential for purchasing a property below market value. Banks are often eager to offload these properties to reduce their holding costs, which can lead to significant savings for buyers.

Another advantage is the clear title that typically comes with bank owned properties. Since banks handle the foreclosure process, they ensure that any liens or unpaid taxes are cleared before selling the property. This reduces the risk for buyers and simplifies the purchasing process.

Additionally, the potential for appreciation and profit is significant, especially for those willing to invest in repairs and renovations. By improving the property’s condition, investors can increase its market value, leading to a profitable resale or rental opportunity.

Challenges and Considerations

While there are benefits to investing in bank owned properties, there are also challenges that need careful consideration. The “as-is” nature of these sales means that properties may require extensive repairs, which can be costly and time-consuming. Buyers should be prepared for unexpected expenses and delays during the renovation process.

Financing can also be a hurdle, as some banks may not offer traditional mortgage options for properties in poor condition. Buyers may need to explore alternative financing options, such as renovation loans, to cover the cost of repairs and the purchase price.

It’s also important to conduct thorough research and due diligence. Understanding the local real estate market, property values, and potential resale opportunities can help mitigate risks and ensure a successful investment.

Conclusion: Navigating the Bank Owned Property Market

Bank owned properties offer unique opportunities for investors and homebuyers willing to navigate their complexities. By understanding the acquisition process, advantages, and challenges, individuals can make informed decisions that align with their investment goals. While these properties can present risks, they also hold the potential for significant rewards for those prepared to invest time and resources.

For anyone considering entering the market, working with experienced real estate professionals and conducting comprehensive research are crucial steps toward a successful investment. With the right approach, bank owned properties can be a valuable addition to a real estate portfolio.